Electronic bill

To Request your SAT invoice. There are two cases for this process

Mexican Companies

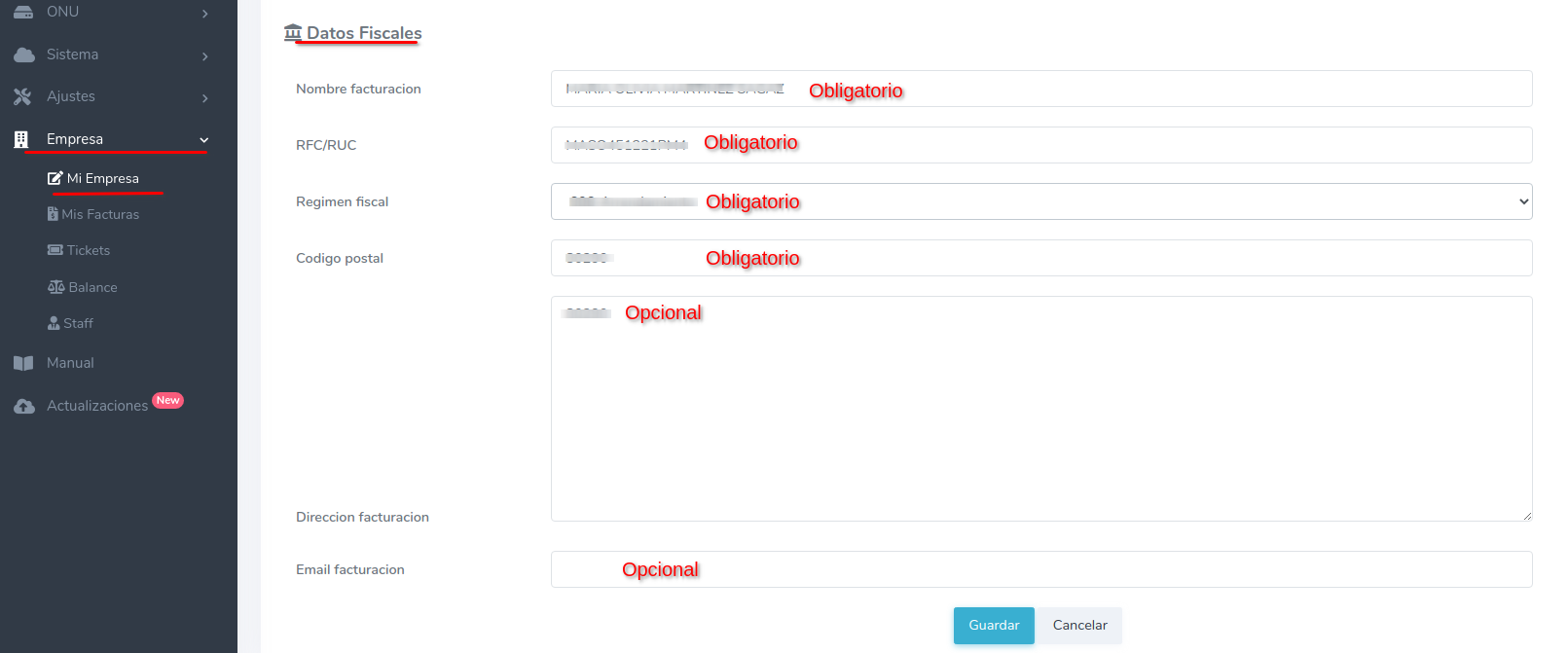

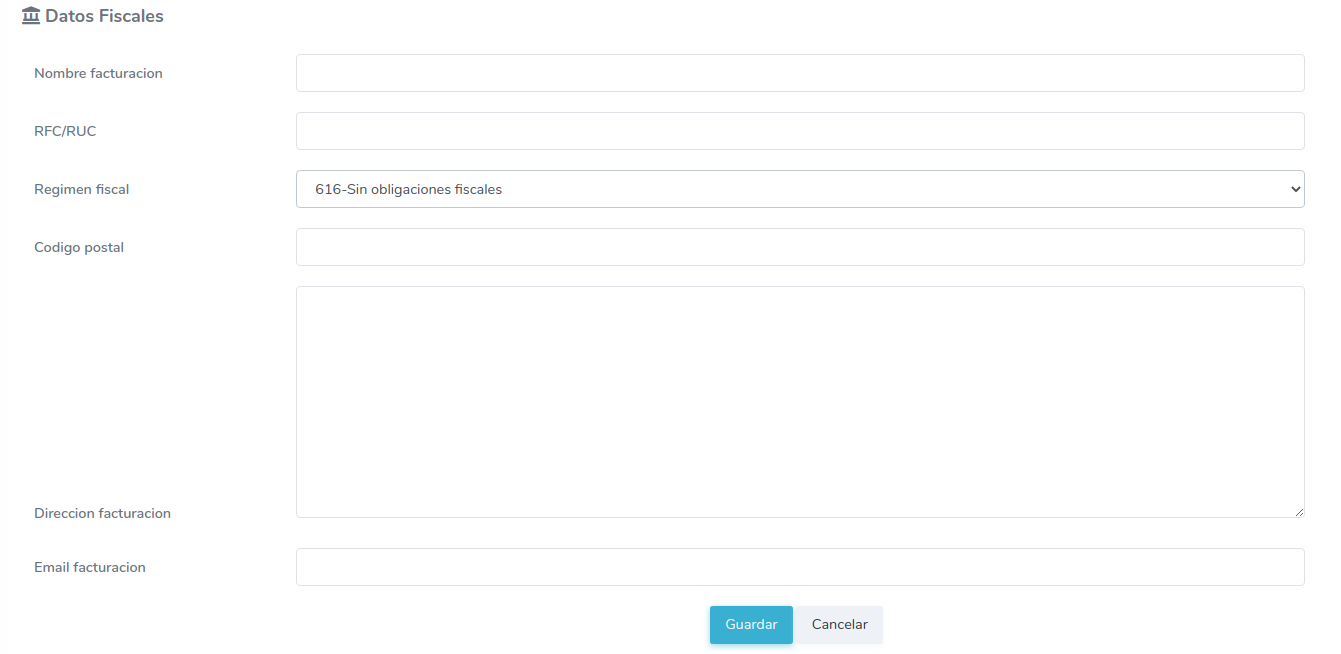

1Enter Company > My company

Fill out this form with your tax information.

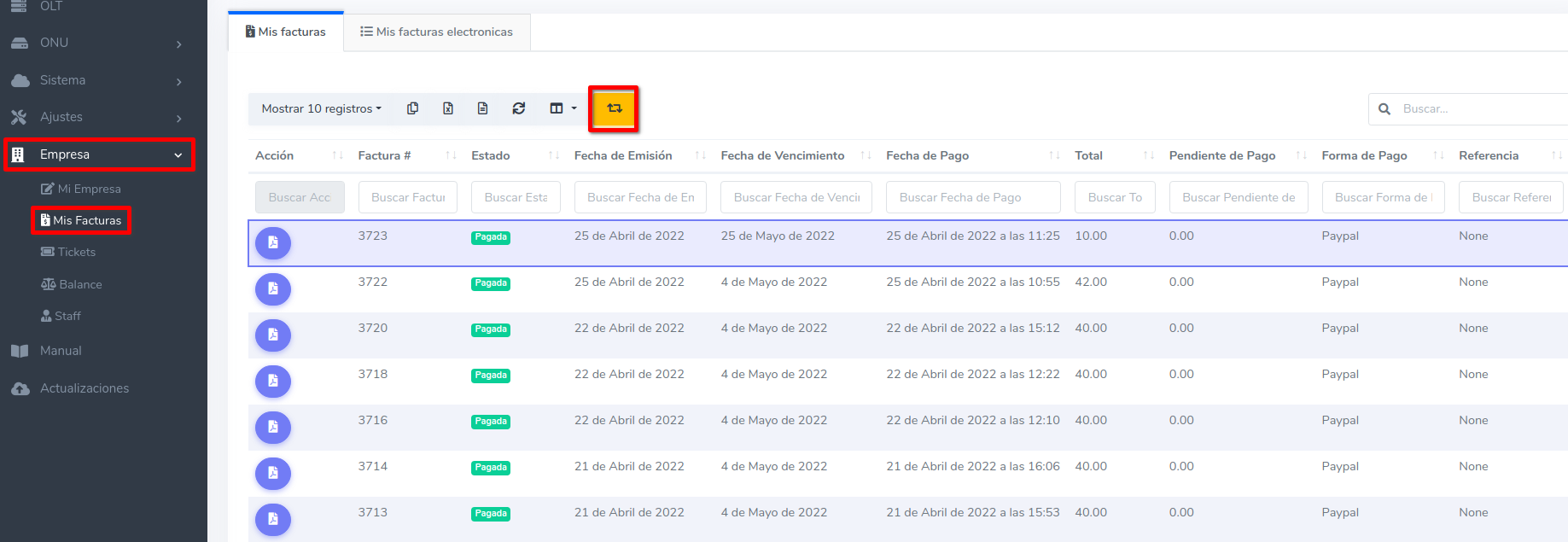

2Enter Company > My Invoices

You have to select an invoice so that the yellow button to generate electronic invoice appears. Which will redirect you to the stamping screen.

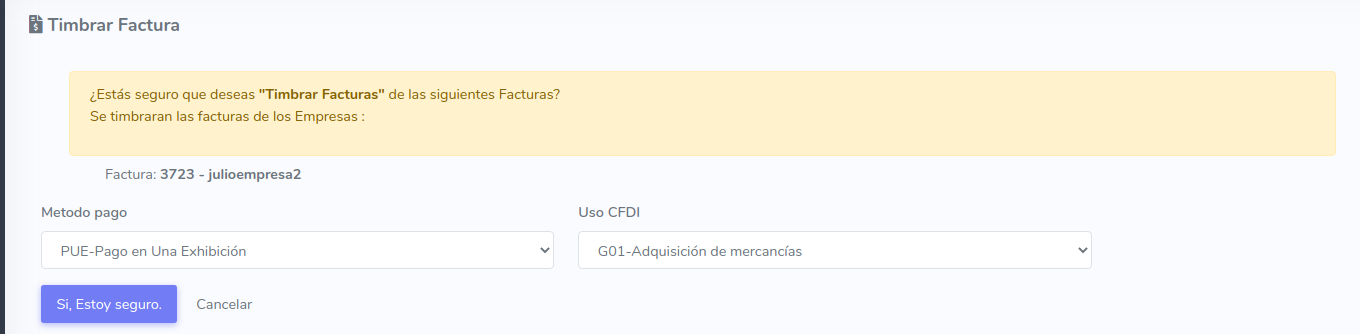

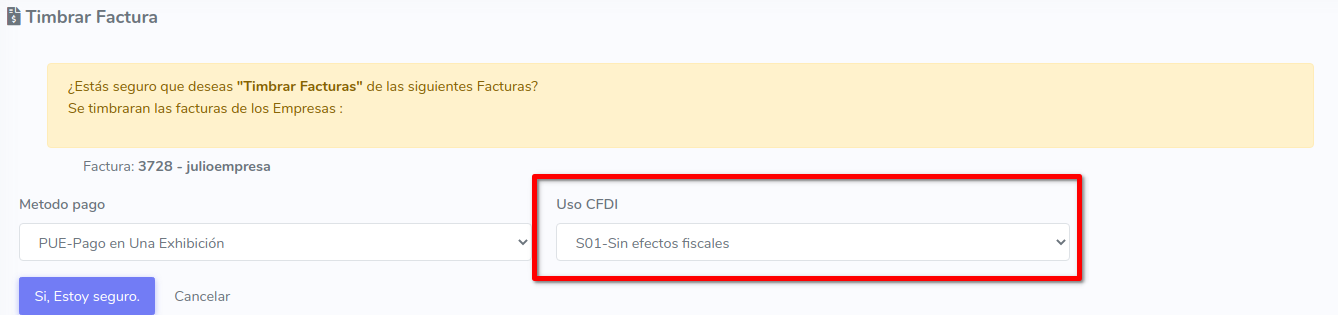

3Invoice stamp screen

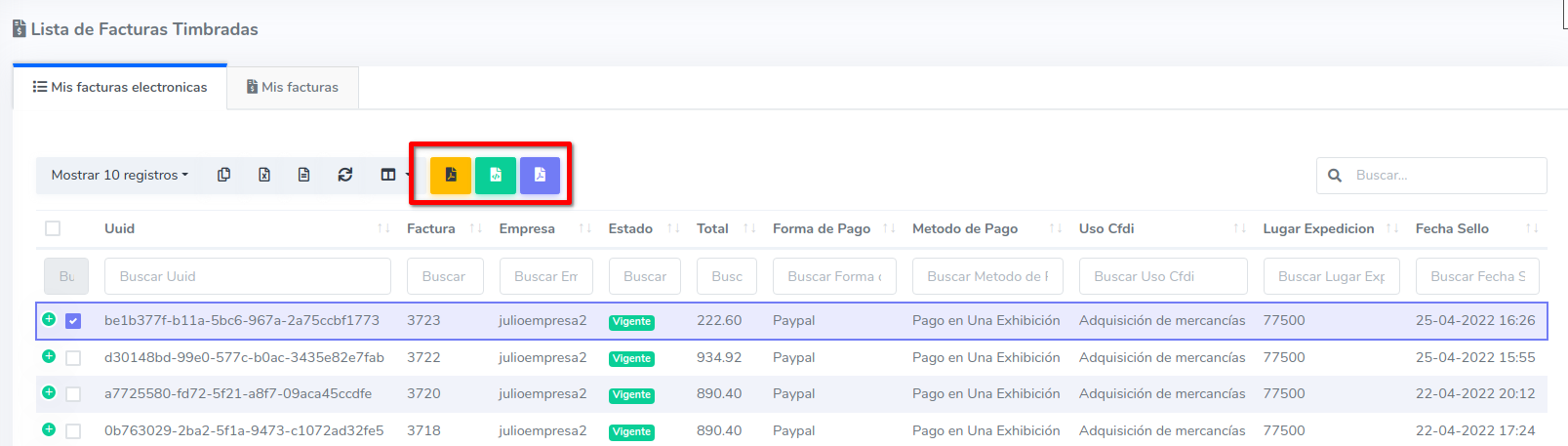

4List of stamped invoices

You have to select an electronic invoice so that the buttons appear so that you can perform various actions such as viewing cfdi in pdf, downloading in xml and viewing the invoice.

5Electronic invoice from Mexico PDF

Foreign Companies

1Connect with technical support

In order for a foreign company to generate its SAT Tax Invoices, it is necessary to notify technical support ([email protected]) so that they can activate the stamp option.

2Enter Company > My company

It is not necessary to fill out your tax information, in this case you can leave it empty

3Enter Company > My Invoices

This step is the same as paso 2 of the Mexican company

4Invoice stamp screen

Important to have CFDI Use Selected in S01-No tax effects

5List of stamped invoices

This step is the same as paso 4 of the Mexican company

6Electronic foreign invoice PDF

The PDF shows some different data such as the RFC, the generic is taken and the VAT is not applied.

April 12, 2024, 3:32 p.m. - Visitas: 18047